Whether you have a specific need such as helping your children with their education expenses, making sure your insurance cover meets your needs or you’re considering how to develop and implement a tailored retirement, wealth creation, or wealth management plan, we can help.

When it comes to financial planning our focus is to work with you to achieve your lifestyle and financial goals by helping you plan and take action to create, manage and protect your wealth.

Whether it’s through the assessment of fund managers or helping you find your lost superannuation, we can assist you regardless of what stage you are at in life.

Our advice on retirement planning will assist you to ensure that your assets, capital and income streams outlive you, so that you have enough to live on in retirement.

We can help you manage your taxation issues, to ensure you comply with tax legislation and only pay the amount you are required to.

We can discuss the different elements to building a suitable estate plan for you, and work with your Estate Planning professional to ensure the implementation and ongoing review of this.

Recipients of new wealth have many financial issues to consider. We can help you navigate strict tax and inheritance laws and create a financial plan that makes the most of your inheritance.

We can help you find the best structure for your particular circumstances. We will work with you to select the right products and levels of cover to protect your income stream when you are unable to earn an income due to illness or injury, or to provide for your family in case of death or disability; while maximising cost savings in the process.

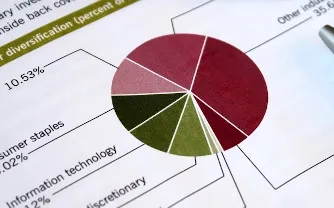

With literally thousands of investment options to choose from, navigating the minefield of fees vs. performance and risk vs. reward is fraught with danger. However, as we’re not aligned with any financial institution, our recommendations are about you and your goals, not limited to the choices set by a corporate or institutional master.

We can assist you with Centrelink calculations and strategic planning advice. Centrelink may be able to assist you with your income in retirement. Boosting your income with the Age Pension or other Government benefits can be a great way to navigate retirement and make your superannuation last longer.